Introduction

Finding the right auto insurance can feel overwhelming, especially if your driving record isn’t spotless. Many drivers are rejected due to past mistakes. Others face sky-high premiums they can’t afford. That’s where The General Auto Insurance steps in. Known for accepting drivers that others often turn away, this company offers fast quotes, easy coverage, and no judgment. It’s not just about paperwork—it’s about peace of mind.

What Makes The General Different

This insurer doesn’t focus on your past. Instead, it focuses on getting you back on the road. If you have a history of accidents, tickets, or no prior insurance, most companies may label you as a risk. The General, however, offers coverage with fewer barriers. That’s what makes it stand out. It gives drivers a second chance without making them feel like they’re being punished.

The application process is quick. You can get a quote within minutes and be insured the same day. It’s ideal for anyone in a hurry or needing immediate proof of insurance. This is especially useful when buying a car or renewing a license.

Company Overview

General Auto Insurance was founded in 1963 and has been serving customers for over five decades. Today, it operates in most U.S. states and is part of the American Family Insurance group. That connection gives it both financial stability and customer trust. Over the years, it has established a reputation for assisting drivers who struggle to find coverage elsewhere.

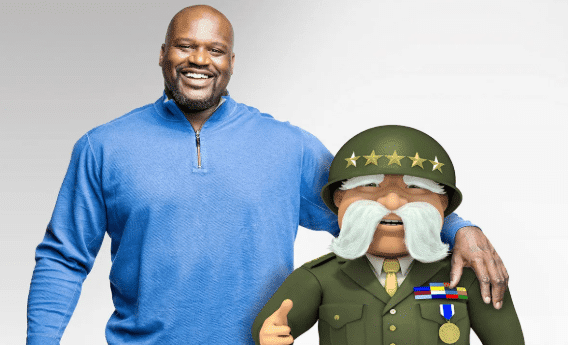

It’s more than a catchy commercial. The company is licensed, recognized, and respected. For people who think they don’t have options, The General proves otherwise.

Who Should Consider The General

This insurance is ideal for individuals who have had difficulty getting approved elsewhere. That includes those with:

- Previous traffic violations

- Lapses in coverage

- DUI or reckless driving history

- Poor credit or no credit

It’s also suitable for first-time drivers, especially those who need fast and affordable insurance with minimal hassle. If you’ve ever been denied coverage or quoted extremely high prices, this could be your best bet.

Coverage Options

The General offers all the essential types of auto insurance. These include basic liability, collision, and comprehensive plans. You can also choose medical payments coverage, uninsured motorist protection, and roadside assistance.

Another benefit is the availability of SR-22 filings. Many drivers are required by law to carry an SR-22 insurance policy after committing certain offenses. Not all providers handle these forms quickly, but The General does. It simplifies the process and files the form for you.

Flexibility is another strength. You can choose monthly or even bi-weekly payments. This helps people budget more easily without worrying about large upfront costs.

Getting a Quote

The process is simple. You visit the website, enter your zip code, and fill out some basic information. Within minutes, you get a personalized quote. If the price works for you, you can proceed to payment. After that, your proof of insurance is ready to download.

This fast turnaround is one of the company’s strongest features. There’s no long waiting period or complex paperwork. Everything happens online, and support is available if you need help along the way.

Claims and Customer Service

The General makes filing a claim straightforward. Whether online or over the phone, their team guides you through the process. Claims are typically processed within a few days, depending on the specific circumstances.

Customer service is available through the app, website, or phone. While some users have noted room for improvement in support speed, many others appreciate the convenience and fast access to documents.

The company also offers a mobile app, allowing users to manage payments, download insurance cards, and update their policies. It’s a helpful tool that adds to the modern, hassle-free experience.

Costs and Discounts

Pricing may vary depending on your state, driving history, and vehicle type. For high-risk drivers, premiums may be higher. However, the General’s flexible payment options help offset that.

Discounts are available, but not as extensive as those offered by other providers. Some common savings include safe driver discounts, multi-car policies, and automatic payment discounts. The best way to lower your rate is by maintaining a clean driving record over time.

Pros and Cons

One of the biggest advantages of using The General is accessibility. They serve drivers that others won’t, and they do it fast. Their online system is easy to use, and there are no hidden requirements.

On the downside, prices may be higher for some customers, especially those with severe driving records. Additionally, there are fewer options for bundling with other types of insurance, such as home or life insurance.

Still, for people who need car insurance quickly and without judgment, the benefits often outweigh the costs.

Customer Experiences

Many users share positive stories about obtaining coverage after being rejected elsewhere—some discuss needing insurance the same day to purchase a car or keep their job. The General helped them do that. Others mention the ease of use and clarity of the website.

While some reviews mention higher rates, the common theme is appreciation for being approved at all. It’s not always about getting the cheapest plan. Sometimes, it’s just about getting a plan you can count on.

Is It Right for You?

If you’re someone who’s been denied coverage or quoted outrageous prices, then yes. The General may be a smart move. If your driving record is spotless, you might find better deals elsewhere. But for many Americans, this insurer is a practical, honest, and helpful option.

Remember, driving without insurance can result in fines, a suspended license, and even jail time. Choosing a company that offers fast, no-hassle coverage is a decision that protects both your wallet and your freedom.

Conclusion

Not all drivers have perfect records. That doesn’t mean they don’t deserve reliable protection. The General Auto Insurance fills that gap. It gives people a chance to drive legally, affordably, and confidently.

From instant quotes to SR-22 filings, the company understands the real needs of high-risk drivers. While it might not be the cheapest for everyone, it offers something far more valuable—access, speed, and understanding. If you need car insurance fast and can’t afford to wait or be judged, The General could be exactly what you’re looking for.

Frequently Asked Questions

How quickly can I get insurance from The General?

You can receive a quote and activate your policy within minutes. Proof of insurance is available instantly online.

Does The General offer coverage in all states?

It currently offers coverage in most states, but availability may vary depending on local laws and regulations.

Can I use The General if I need an SR-22?

Yes, The General specializes in serving drivers who require SR-22 filings and can process them quickly.

What if I have bad credit?

The General does not base its decision solely on credit scores. You may still qualify even with poor credit.

Is it easy to manage my policy online?

Yes. The website and mobile app allow users to make payments, file claims, and access documents 24/7.